Venezuelan state oil firm PDVSA has issued at least $310 million in debt to companies including General Electric Co as it negotiates private issuances to pay off its suppliers, industry sources told Reuters, stretching the finances of a company that bondholders already worry is on its way to default.

Photographer Diego Giudice/Bloomberg News

The securities are not bonds but offer rights similar to those enjoyed by bondholders, and at least one issue offers dispute resolution via the Paris-based International Chamber of Commerce, according to one of the three sources, who cited a term sheet.

This means that if PDVSA defaults, investors holding their bonds may find that there are more creditors competing for compensation than they had originally anticipated.

The overall negotiations on private debt issuance, which were confirmed by seven sources, come as weak oil markets and an unraveling socialist economy have fanned concerns PDVSA will be unable to make nearly $5 billion in bond payments between now and the end of the year. PDVSA and Venezuelan President Nicolas Maduro insist they will meet all debt obligations and dismiss default rumors as a right-wing conspiracy.

In addition to the $310 million, a package of $1.5 billion in such securities maturing in three to five years is being discussed as a way of settling debts with small and medium-sized oil services firms, according to one of the sources, who was briefed on that proposal.

PDVSA is struggling to prevent oil services providers from stopping work in Venezuela in protest over billions of dollars in unpaid bills.

The company has worked with banks including Deutsche Bank AG to structure fixed-income securities such as promissory notes that can be sold to investors, according to one of the sources, a local trader who saw documents outlining the proposal.

“PDVSA has been offering promissory notes as well as other types of notes and financial instruments to settle debts with providers,” said another of the seven sources, who was also involved in one such operation.

Read the full story at Petroleum World.

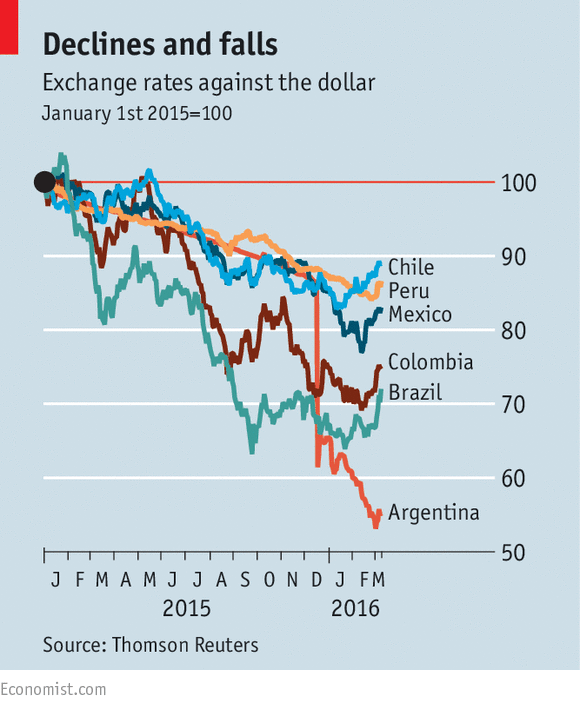

OLDER Latin Americans still have vivid memories of hyperinflation. Bello recalls changing money in dark doorways in the mid-1980s in Bolivia and being handed a truncheon of greasy banknotes secured by rubber bands. Peru went through a futile currency reform in which the sol lost three zeros and was briefly renamed the inti, which promptly racked up more zeroes.

OLDER Latin Americans still have vivid memories of hyperinflation. Bello recalls changing money in dark doorways in the mid-1980s in Bolivia and being handed a truncheon of greasy banknotes secured by rubber bands. Peru went through a futile currency reform in which the sol lost three zeros and was briefly renamed the inti, which promptly racked up more zeroes.